Cryptocurrency is e-money turned a notch higher. Although built on an entirely different framework than that of electronic payment systems, the risks associated with both are almost the same. But, the scale of the theft and nascent nature of the technology makes people who invest in cryptocurrency susceptible to a higher risk. Till developers come up with ways to resolve the holes in the architecture of the underlying technology, blockchain, the risks of cryptocurrency are expected to remain high.

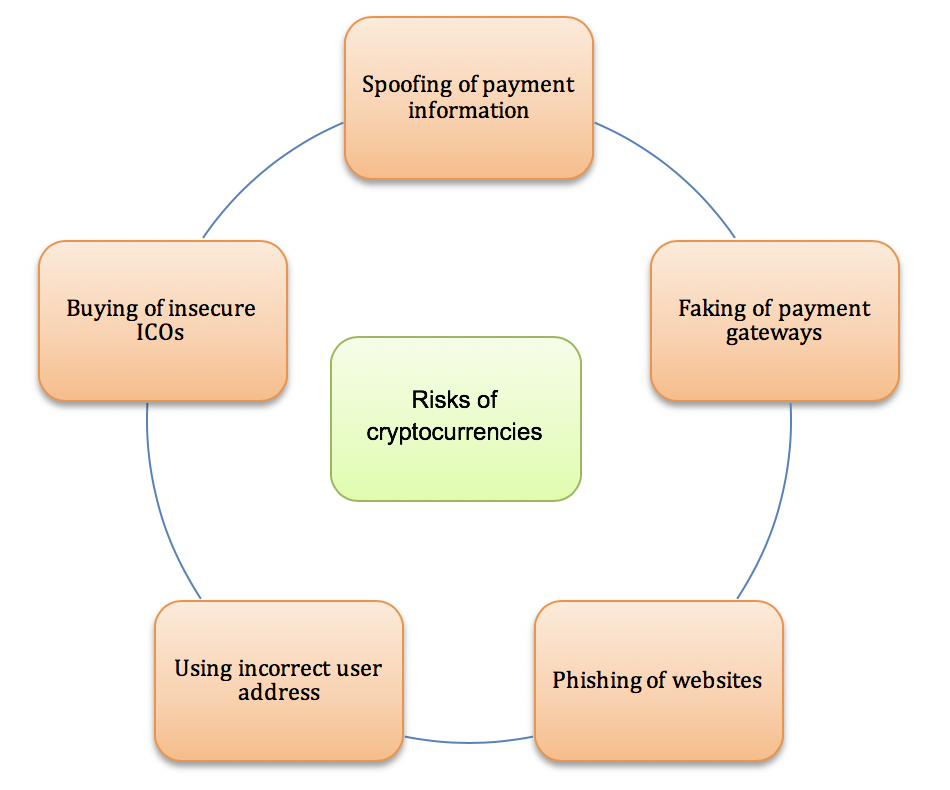

Common risks of cryptocurrencies

Considering the underlying technology that cryptocurrencies work on, they experience all risks associated with online data. Following are some of the common risks and challenges of cryptocurrencies that are inhibiting its complete integration in our finance economy.

● Spoofing of payment information

These types of errors occur due to the presence of malware in a user’s system. The malware acts when a user uses their e-wallet to make a payment and replaces the recipient’s wallet address with its own, directing the money to a wrong account.

● Phishing of websites

Just like e-commerce websites and payment portals experience phishing attacks, cryptocurrencies also go through these attacks where a cryptocurrency owner is tricked into entering the wallet details on a fraudulent website by disguising it as a payment portal. Once the details of the wallet are obtained, enormous amounts of money can be drained from the wallet without the user’s knowledge.

● Faking of payment gateways

Attackers, rather than introducing an unfavorable agent in your payment, pose to be the real recipient on your payment network. They convince the server that they are real endpoints to which the money should be directed. Thus, any transaction done using the cryptocurrency is directed to an unauthorized user.

● Buying of insecure ICOs

ICO stands for Initial Coin Offering. It is a type of funding used to establish new cryptocurrency services online. The year 2017 saw a sudden spike in the investment of these currencies. Nearly $1.7 billion was raised solely by the purchasing of ICOs. The problem here is that many of these currencies, however, aren’t secure. Without any assessment, management, or ways to check the veracity of the source, a lot of these ICOs turn out to be fake, thus causing substantial monetary losses to many investors.

- Using incorrect user address

Another major risk that occurs due to the carelessness on a user’s end is when an incorrect wallet address is entered. The payment in progress either vanishes in thin air or the amount changes to something much more than you intended to transfer. In the case of Ethereum, the amount gets multiplied by 256. Unlike conventional banking, cryptocurrency trading has no means, as of now, to trace and refund any such inaccurate transactions.

Ways to avoid cryptocurrency risks

Users are expected to check the recipient’s address before initiating the money transfer. It is also advisable to employ safe and familiar payment portals to transfer funds. Any new site or platform should be verified before blindly trusting it. People should also research for reliable ICO companies before investing in any cryptocurrency ventures.