To gain digital value creation, banks will have to fundamentally transform the way banking processes, clients, and banking executives operate. For implementing digital technology in banking, they must change their execution model to become more digitalized.

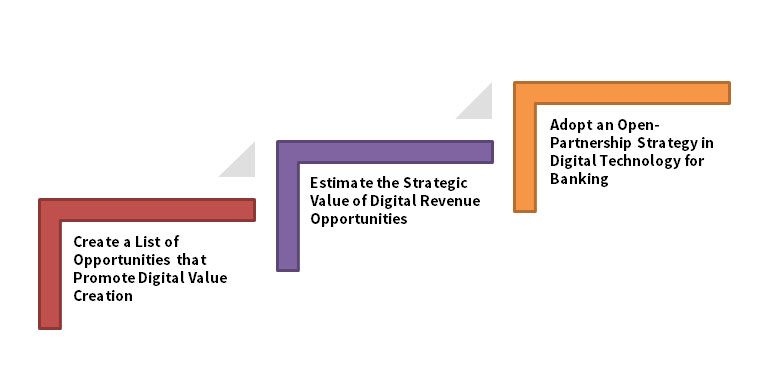

What are the steps in generating digital revenue?

1. Create a List of Opportunities that Promote Digital Value Creation

The first step in the process of digital value creation is identifying and describing the potential digital revenue streams that can be applied to a bank’s target objectives. CIOs must understand and explain each opportunity that provides digital revenue. CIOs can prepare case studies for further strategic and market use.

Take a look at the following table.

|

Scope of Digital Revenue |

Segment |

Description |

Enabling Technologies |

|

Data Brokerage |

Retail |

This scope explores a proposition where clients are |

Enterprise data warehousing and mobile cloud |

|

Personal Data |

Asset and Wealth |

This venture explores |

Cloud computing and IOT |

|

Client Credential Tracking |

Digital Business |

This scope explores tracking of customer |

IGA and IAM |

Thus, CIOs can prepare a similar table as given above for studying use cases.

2. Estimate the Strategic Value of Digital Revenue Opportunities

The second step in incorporating digital technology in banking is that CIOs need to evaluate the capacity of new digital revenues streams to create a positive impact on the client and boost their customer engagement strategy and financial institution performance.

Let’s take a look at how to create an evaluation template to determine the strategic value of digital revenue streams.

|

Number |

Client Expectations |

Bank Performance |

ROI |

|

1 |

Saving time |

Boosts revenue |

Payback Time |

|

2 |

Providing transparency |

Increases productivity |

Existing gaps in |

|

3 |

Giving advanced security measures |

Minimizes frauds |

Secured firewall solutions |

You can use the following scale to calculate the impact of a use case on the bank’s performance.

0 = No impact

1 = Very low impact

2 = Low impact

3 = Medium impact

4 = High impact

5 = Very high impact

You can place this indicator against each use case to evaluate which will provide optimum benefits to banks.

3. Adopt an Open-Platform Strategy for Implementing Digital Technology in Banking

By adopting an Open-Platform, banks can promote the development of business ecosystems. It will help CIOs in determining a bank’s industry vision and assist them in enabling value-creating conversations with clients. An Open-Platform strategy can also facilitate development and exchange of financial products, services, and social currency. It also allows banking platforms to share technological assets like data, algorithms, and interactions between people, and monetary transactions.

For enabling digital value creation, CIOs must focus on developing mobile channels that can pool data from various locations and provide valuable insights into a customer’s financial journey. By utilizing these insights to develop new products and services, digital technology in banking can be implemented successfully.