We live in a digital world and organizations generate and collect digital data for better digital transactions. Vast chunks of data get assimilated daily and it is essential to maintain all the received data, along with meeting the security constraint. However, organizations fail to exploit the digital assets entirely and it is crucial that the collected data must be put into use as these bits of information can sometimes contain significant hidden data hidden, which can drive the business to a new path. According to IBM, over 80% of data is dark data and it is expected to rise to 93% by 2020. However, every data that is generated and collected can be processed accurately with the use of big data analytics. Big data analytics aims at analyzing, storing, querying, and updating these substantial voluminous amounts of data. Big data in finance industry helps business users to gain better insights from the collected financial data and determines the meaning of data; thus assisting them in transforming their industry to a new entire new level.

Challenges faced by the finance industry

The finance industry faces specific problems with the traditional data management models. One of the significant challenges faced is the fraudulent activity that is the growing concern. The conventional model lacked to maintain the security of digital assets, which enabled hackers to achieve vital customer or industry data. Hence, there generated a need to overcome this challenge at the earliest, since there was a high risk that the industry would burn out. Another major problem faced is the analysis of sentiments of customers. Customers are real wealth for any organization, and every industry must keep fulfilling their customer’s ever-increasing demands. The traditional model, however, does not provide any technique to analyze their customers. Moreover, conventional model lacked in segmenting their customers based on their transactions and other internal and external processes. Furthermore, business users cannot target the right audience for their marketing purpose with the traditional model. The list is endless, which generates the need for an advanced technology that could help the business users to overcome these challenges and achieve impactful results for the financial industry.

Big data in the finance industry

As we are aware of the challenges that the finance industry faces with the traditional data management models, it is high time to leverage big data technologies in their industry and overcome challenges. A few years back, a survey said that 84% of enterprises see big data analytics changing their industries’ competitive landscapes. This states that big data analytics can transform various industries, including the finance industry. Big data analytics helps the finance industry to maintain security and privacy of the collected data by the use of predictive analytics.

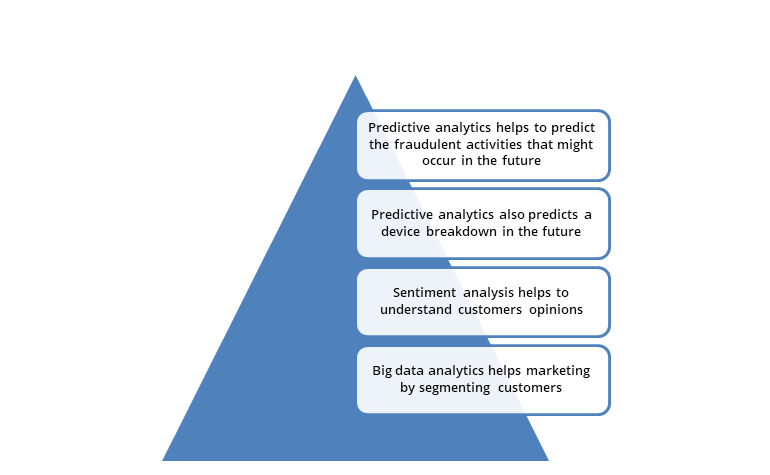

Predictive analytics helps in predicting any fraudulent activity in the future, thereby helping detect hackers. Additionally, predictive analytics could be used to predict a machine breakdown, if any. Furthermore, big data analytics could be used by the finance industry for their marketing purpose. Through social media platforms with sentiment analysis researchers can gather sentiments, opinions, and feedbacks of customers that can help them alter a business if itscustomers are unhappy. This helps the business users to analyze their customer better and alter their business if the need to be. Furthermore, big data analytics helps in customer segmentation, which allows the industry to find the right target for their business. Business users can, thereby, boost their marketing skills and make maximum profits.

According to an IBM survey, more than 25% financial institutions are using big data analytics to stay ahead of the curve. Big data in finance help business users identify real-time customer sentiments, prevent fraud, improve marketing tactics, and accelerate their business growth.