This is given the multiple players we have in the banking sector today. Moreover, banking is a sector that thrives on profit making. Thus spending exorbitantly on sales and marketing is not a fertile plan for evolution and innovation.

This is given the multiple players we have in the banking sector today. Moreover, banking is a sector that thrives on profit making. Thus spending exorbitantly on sales and marketing is not a fertile plan for evolution and innovation.

The banking industry is not the only one in need of a dramatically different business model to up its profits and increase its customer base, while keeping its cost overheads in check. That can be quite tricky, right?

Well, not really. In the age of Internet, the unprecedented is bound to happen. Innovation is the buzz word. Internet has been, and continues to be the game changer. It has in store a solution for problems we didn’t even think we’d have to face.

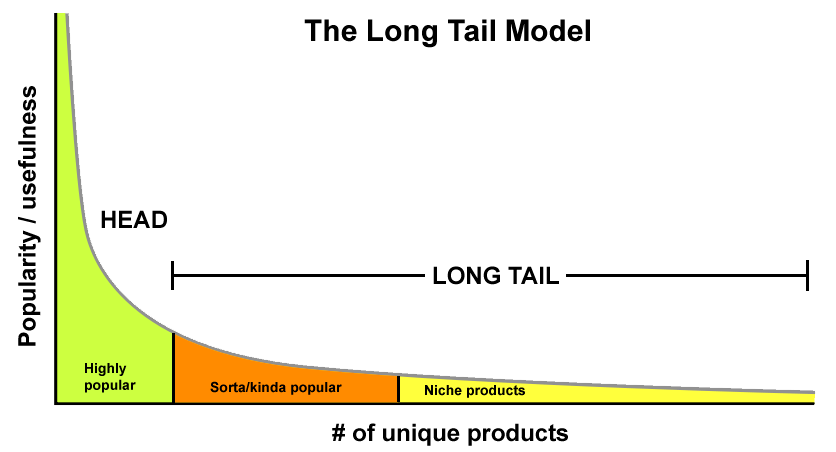

The long tail model of business is one such solution for industries like banking, that aim at changing the dynamics of how sales are made and what is sold. Internet as a medium and long tail as a business model, help banking diversify its customer segment and the services it offers.

The traditional approach

Banks have, for the longest time, focused on account management as the primary source of their money making. Account management involves reaching customers through KYC and AML requirements, telephone and in-branch services, as well as transaction processing.

This approach misses out on people who do not have a bank account, i.e. the unbanked. Not just that, it also misses out on children, students, pensioners, migrant workers, the welfare market, the grey market, and much more.

Physical banks are like physical stores limited by shelf capacity. They use their limited space to make available the most popular services to their mainstream customers (read as customers with bank accounts).

The long-tail approach

Long tail in banking creates a mass market of niche customers. It allows banking to expand its customer diversity. Long tail in banking enables the unbanked and underbanked customers to avail services pertinent to their needs. The greater the number of different consumer segments, the longer is the tail.

Microfinancing, PayPal, social lending sites like Zopa and Prosper, prepaid cards, and mobile payments. These are the many ways in which the banks can reach out those customers whose needs are different from the usual ones.

The best part is that long tail in banking ensures that the banks are still making profits, just the way they do with traditional banking. The niche transactions, that occur over the internet, involve no overhead costs for their management. As the niche transactions build up, the small profits become big. Although the customers targeted by long tail in banking have no established credit history, they form a significant niche market, and are a crucial component of economic growth globally.

With long tail in banking, the distant future may not think of banks as brick and mortar spaces at all. They will become more of an omni-channel function composed of many different players, providing different services .